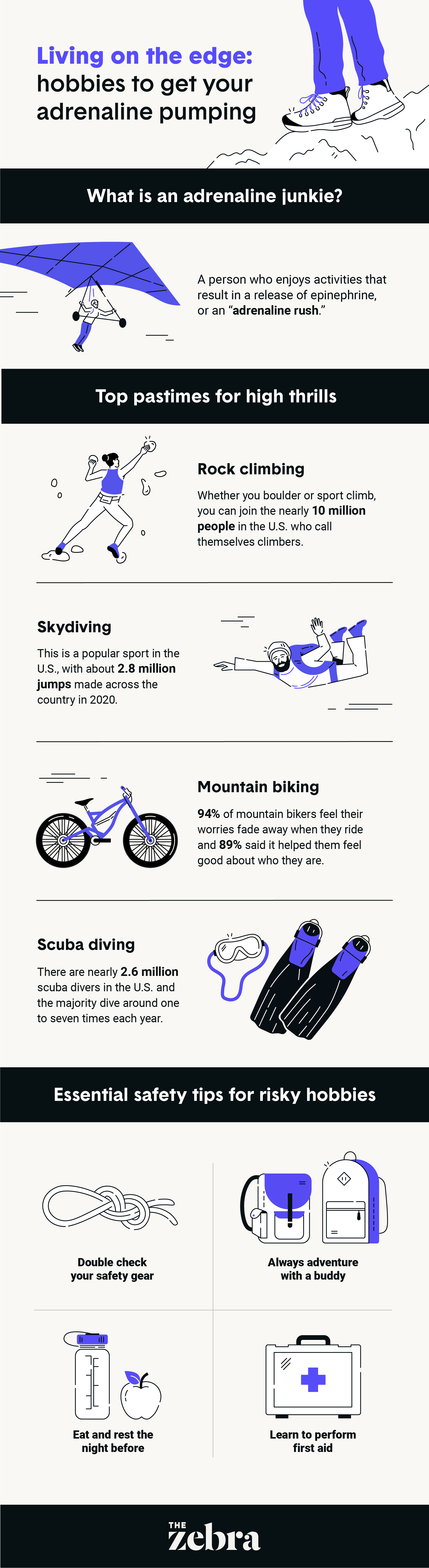

You can’t put a price on the rush of adrenaline that comes with a little danger… or can you?

Well, as it turns out, you can. Taking part in a risky outdoor sport or hobby can be incredibly fun, but it can also boost your life insurance costs. Read on to find out more about high-risk hobbies and their relationship with life insurance.

(Image Source: unsplash.com)

Common High-Risk Hobbies

After COVID-19 hit, nearly every activity that included other people became “high risk.” However, there are some activities and hobbies that have been considered high-risk by insurance companies for a while.

Skydiving

Of course, skydiving would rank highly as a risky activity. However, skydiving seems more dangerous than the statistics suggest. According to the U.S. Parachute Association, only 11 skydiving fatalities occurred in 2020 (out of around 2.8 million jumps).

The insurance price for skydiving is highly dependent on how often the person jumps. The more jumps a person does per year, the higher the price can raise.

BASE jumping

BASE jumping is widely considered to be one of the most dangerous extreme sports. Many life insurance companies refuse to offer insurance plans complacent with BASE jumping. However, the ones that do offer plans sometimes take certifications and experience into account.

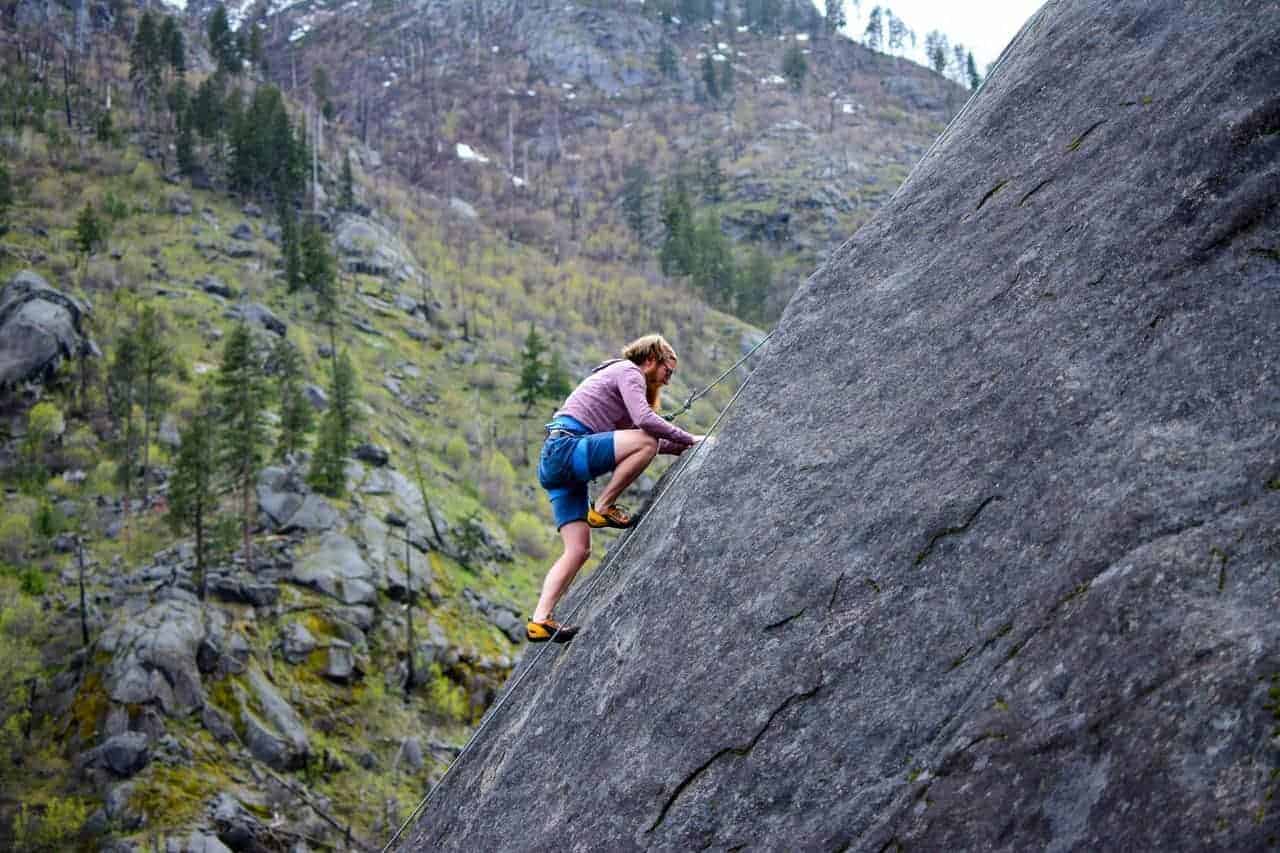

Rock climbing

Rock climbing is considered safer if the climber is mostly indoors on climbing walls. It changes once the climber leaves the gym. Outdoor climbing—especially mountain climbing—is deemed far more dangerous. Factors that affect insurance prices include average climb height, the use of ropes, the tallest (recent) climb, and plans for future climbs.

Hang gliding

Although hang gliding and paragliding are considered high-risk, most of the active participants in these sports are usually able to obtain life insurance policies. The factors affecting insurance usually include the type of aircraft, the frequency of flying, and the average altitude. Location and training (or skill level) are sometimes considered as well.

Scuba diving

Even though the fatality rate for scuba diving is low, it still can bump insurance prices due to its perception. However, insurance companies can be flexible on this, especially when taking into account the type of diving and the frequency.

Those who scuba casually likely won’t have issues with insurance prices. The other factors that affect insurance typically include certification, depth, and the risk of the dives (if they involve caves or spears).

Big wave surfing

Some types of surfing are more dangerous than others. Perhaps the most dangerous type of surfing is big wave surfing. It’s exactly what it sounds like: surfers chase the biggest waves they possibly can. Even though there’s no real way to measure the size of a wave (other than the photograph), the largest wave ever surfed is estimated to be somewhere from 80 to 100 feet tall. Few surfers meet fatal ends, but injuries can be drastic.

Insurance companies take into account the frequency of surfing, the wave height, and the surfer’s record of falling to determine policies.

If you love one or more of these activities (or you’re looking to get involved), don’t worry. Going rock climbing once won’t automatically make your insurance prices skyrocket. Read on for more information about how to balance your lifestyle to minimize insurance costs.

Tips for High-Risk Lifestyle

Whether you prefer one or many high-risk outdoor hobbies, you should still make an effort to keep yourself safe before visiting a dangerous place or embarking on a risky adventure.

Stretch, warm up, or prepare:

Some activities take more preparation than others. Do what you can to prepare. If you need to train, train. Don’t pick up an extremely dangerous sport unless you feel qualified to do so. On the day of, make sure your body is ready and reactive by warming up.

Bring adequate gear

Some gear can be costly, but it’s worth it. View the gear as an investment in yourself. Don’t skimp on something that could be saving your life.

Start slow

Don’t jump into a life-threatening activity right off the bat. No one can do everything perfectly at first. Don’t feel the need to push yourself, even if you’re surrounded by people who are above your skill level. Keeping yourself safe should be one of your top priorities. After all, these activities are about enjoyment, and there’s no fun in feeling pressure all the time.

Get regular exercise

If you’ve been training for something, it’s important to round out that training with regular athleticism. For example: instead of rock climbing every day and hurting your elbows, try going to the gym and making sure you’re targeting different muscle groups for a well-rounded athletic foundation.

Take breaks

Giving your body time to rest and recover is just as important as training hard. All your exercise and training won’t come in handy if your body doesn’t have time to absorb it. You’ll need to get enough sleep for your recovery and energy levels to be at their best. Take mental breaks, as well. High-risk activities can put your body in states of stress, and it’s important to decompress after facing the intensity of these activities.

Go with a partner

The last thing you want is to get lost by yourself. Even if you’re highly prepared, there are situations where you might find yourself in a pickle. The solution? A partner. Having someone accompany you can decrease the odds of disaster by tenfold.

At the end of the day, only you know what you’re comfortable doing. Listen to your body, and go at a pace that’s comfortable for you.

Do I Need Life Insurance?

Maybe you have a proclivity for a high-risk lifestyle. That’s okay—but you might want to make sure you’re covered in case of an emergency. Read on to find out if high-risk life insurance is something that you’ll qualify for, and if it’s worth your investment.

What is high-risk life insurance?

As you may have guessed, high-risk life insurance covers those who are risky to insure. Although this article focuses on sports and hobbies, other risk factors that can contribute to the determination of high-risk life insurance are careers, habits, travel, and health conditions or illnesses.

How do I make high-risk life insurance more affordable?

Even if you live a high-risk lifestyle, you can still do things that will counteract the increased prices.

Compare companies and policies

Taking a look at your options is one of the best ways to get yourself a good deal. You can find companies that offer competitive rates, and different companies have varying standards for coverage. Do background research on an insurance comparison website to get some information before or during negotiations with companies.

Improve your health

Your life expectancy is a determining factor in insurance policies. If you have health conditions, you’ll want to do your best to keep yourself healthy to keep the costs down. For example, a person with high cholesterol who does their best to watch their diet and exercise will have a better chance of lowering insurance costs than someone who is less proactive.

Consider lifestyle changes

If multiple factors make your life high risk, consider changing one of them to drop the insurance rates. Insurance companies are more willing to offer lower rates to someone who participates in dangerous habits or hobbies less often.

Typical High-Risk Rating Systems

If you’ve identified yourself as a high-risk candidate, you may be wondering what the process is for determining your rating. First, you’ll apply for life insurance. Once you apply, your application will receive a health rating and risk level. The rating is dependent on your lifestyle and previous health conditions.

A typical life insurance risk rating scale ranges from a “preferred select” candidate to a “table rating” candidate. A “preferred select” candidate would have excellent health, no family history of medical conditions, and would not smoke. A “table rating” candidate would have below-average health and live a high-risk lifestyle.

If you have been identified as a high-risk individual, you will be given a table rating. Those with table ratings are assigned a letter or number that determines how much of a percentage increase will be paid to the insurance company. The ratings typically range from 1 – 16 (or letters A – P), with 1 (or A) being around a 25% increase and 16 (or P) being a 400% increase.

Is Life Insurance Worth It?

If you’re not willing or able to give up a high-risk lifestyle, but you have loved ones that you’d like to take care of, you should consider investing in life insurance. There are strategies to find affordable life insurance. Do your research, and consult with others. Ultimately, it’s all up to you.

Author Bio:

Cristina Thorson is a part-time content writing intern at SiegeMedia and a full-time student at Boston University. She enjoys exploring new pockets of cities, culture, and cat websites (as well as alliterative expressions). In her spare time, she can be found reading books, commenting on movies, and writing anything from advertising copy to feminist satire.